State of the Market: Video Surveillance

The video surveillance market is strong and will continue to grow. It is less a lumbering giant, though, and more an agile athlete, able to pivot and adapt — it just happens to be the largest one on the security court. Any fears of market saturation seem to shrink in the face of the cross-functional video applications, integrations, video surveillance as a service and improving technology, better cyber security, and the unquenchable thirst the world seems to have for having cameras everywhere.

In the U.S., a robust economy and increased awareness of the need for security have fueled the growth in this industry segment, so much so that some security integrators are finding their biggest challenge is learning how to harness that growth and not let it run away with them.

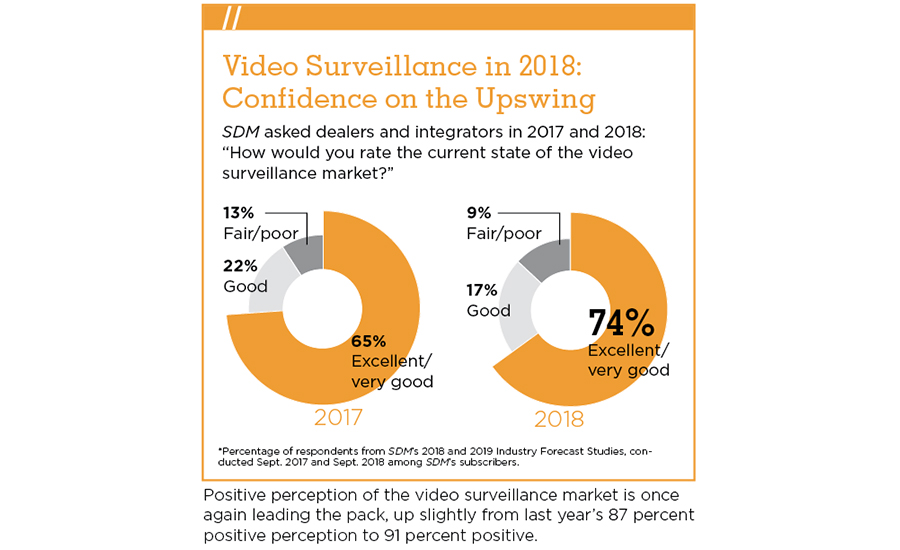

SDM asked dealers and integrators in 2017 and 2018: “How would you rate the current state of the video surveillance market?”

Positive perception of the video surveillance market is once again leading the pack, up slightly from last year’s 87 percent positive perception to 91 percent positive.

Paul Garms, director of regional marketing for Bosch Security and Safety Systems Inc., Fairport, N.Y., says 2018 was one of the strongest they’ve had recently. Garms is bullish not just on video, but on security in general. “We are cautiously optimistic about 2019,” he says. “We will see how the economy develops going forward, but we have a strong project pipeline for 2019 and I think the verticals that we focus on specifically, such as critical infrastructure, retail, smart cities, and public transport systems, we see those continuing to grow this year.”

Scott Dunn, senior director, business development solution and services, Axis Communications Inc., Chelmsford, Mass., says 2018 was a great year. “We are having a very successful year,” he says about 2018, the year in which interviews for this article were done, attributing his company’s growth, in part, to its close work with the entire ecosystem of the security industry. He says Axis is also in the middle of evolving into more than just a product company, but a company with its own solutions. “We have our own services that we are starting to roll out,” he says, “so that enables us to bring value to all parts of the ecosystem instead of just saying, ‘Here’s a camera — go buy it.’ So I think that’s been a key part of our success and why we are experiencing such a great year this year.”

You Keep Using That Word…

“I do not think it means what you think it means,” Inigo Montoya from The Princess Bride helpfully points out to Vizzini, who repeatedly uses the word “inconceivable.”

A common buzzword in video surveillance is “compliance,” although perhaps not everyone means the same thing when they use it. Organizations such as ONVIF have a stated purpose of facilitating interoperability and connectivity between disparate devices and systems. The concept is a necessary and good one as the trend toward connected platforms continues.

“The advancements in connected platforms will likely start to impact the commercial space as the border between consumer and commercial user will become a little more blurred,” says Per Björkdahl, chairman, ONVIF Steering Committee. “The importance of connectivity and interoperability, whether it involves the cloud or different disparate devices or systems, will only continue to increase, and will be a major focus of ONVIF moving forward.”

Understandably, manufacturers want to be seen as doing their part to make their products interoperable and able to be a part of the customers’ connected systems. But some frustration has arisen as integrators find that “ONVIF-compliant” doesn’t always mean what they think it means and manufacturers aren’t exactly throwing the curtains open, so to speak, and allowing anyone to just tie in.

With regard to video surveillance, “ONVIF-compliant only means that you’re going to get a picture,” says Joey Rao-Russell, Kimberlite Corp. She explains that “ONVIF-compliant” means that you can record with any appliance: “NVR, server, whatever — it is going to record the video that is coming through, and it will transmit over the network a specific way. However, the feature sets of being able to monitor, being able to send push notifications, the interaction with customer — all these things are software-driven, and they are not driven by ONVIF. So they may or may not work,” she adds. “And that is very difficult.”

The difficulty is, as Rapid Security Solutions’ Steven Paley describes, that many integrators take the “ONVIF-compliant” claim of manufacturers at face value; while the products might technically be ONVIF-compliant in that you will get the picture when you plug the camera into your system, these manufacturers are all bringing their own sandbox to the party, and it’s not truly plug-and-play. “We’ve had a lot of aggravation where we’re using one manufacturer’s VMS,” he explains, “and then you go to put in this camera that says it is ONVIF-compliant — well, not really. This camera says ONVIF-compliant, and you might be able to see the video stream, but let’s say it’s a PTZ camera, and the PTZ controls don’t work with the VMS.”

In essence, Paley describes, you are allowed to play in the sandbox, but you are limited to a specific pail and shovel. “They want to be seen as being ONVIF-compliant,” he says, “that they work with everybody, but they don’t really tell you until your guy is out in the field for eight hours trying to make it work that, ‘Oh yeah, that feature doesn’t work on that camera with our VMS.’”

Rao-Russell explains, “We need to work better toward getting a more standardized model so that it can really become a kind of buffet for the customer to decide, OK, if you want to have an enterprise-level video system but an entry-level access system, they’re still going to work together, or vice versa.”

Inconceivable.

This state of the market doesn’t seem to have taken anyone by surprise. In fact, a rather robust market is what many projected. “The video surveillance market was quite strong in 2018,” says Jeff Whitney, vice president of marketing, Arecont Vision, Glendale, Calif. Whitney says this is what they forecasted, and it is why Arecont introduced its own VMS system. “We see no indication that the global surveillance market will decrease for 2019, and are quite confident that customers will continue to invest in surveillance.”

Though with some of the aforementioned changes and factors affecting the market, such as greater video surveillance integration, increased VSaaS, a greater migration to cloud, and such, many security professionals — from manufacturers to security dealers and integrators — seem to be taking a more realistic approach and not taking a strong market for granted. Understanding the changes and pivoting with the market is crucial to thriving.

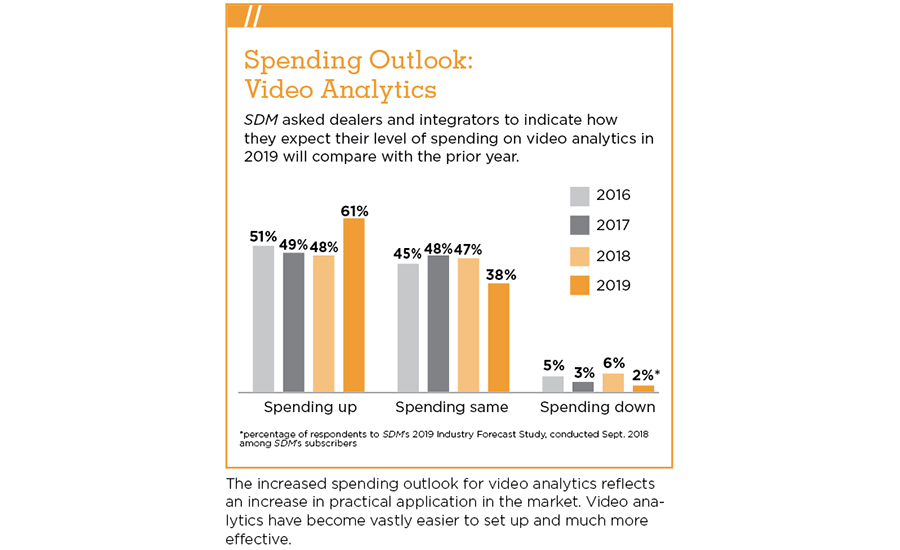

SDM asked dealers and integrators to indicate how they expect their level of spending on video analytics in 2019 will compare with the prior year.

The increased spending outlook for video analytics reflects an increase in practical application in the market. Video analytics have become vastly easier to set up and much more effective.

There is no denying the economy is strong, and that certainly is helping fuel the market; a decade ago, companies were learning to tighten their belts and cut costs, often only to narrowly sidestep going bankrupt. However, while occasionally some may still be tentative, companies are hiring, they’re building new facilities, they’ve got a lot more people and assets to worry about, and they’ve got some money to spend, describes Dunn.

“A good economy definitely helps,” Dunn adds. “Companies can invest, they can hire, and if they need more facilities, they need to protect those facilities. So from an external factor the economy has definitely helped. But the threats haven’t gotten any easier either. We’re getting more complex threats, so of course that is driving the need for security.”

A strong economy, though, cannot alone account for the strength of the video surveillance market. Certainly increased awareness and more knowledgeable customers (who happen to have more capital to invest in security solutions), are helping security integrators up their game in the video surveillance business.

Video Wears Many Hats

One of the themes in this year’s State of the Market report has been the increased adoption of cross-functional use of video. In fact, one of the reasons video continues to defy saturation expectations, is that there seems to be no end to the additional uses for video besides, and in addition to, security.

Paul Garms, Bosch Security and Safety Systems Inc., says he is seeing a great deal of traction with what he calls “using video beyond.”

James Henderson, president and COO, Avigilon Corporation, Vancouver, Canada, explains: “Today there are more cameras at higher resolutions recording more video than ever before — but the vast majority of this data is never viewed. Adding more cameras increases the amount of video data collected, but if it’s not viewed, useful information is missed. As a result, the demand for video analytics is increasing globally.” And with this increase in video analytics, security professionals and end users are finding that video can do much more than capture and store pictures.

Garms says, “We’ve developed special analytics, especially in the retail sector where you can use these video cameras and metadata to drive your business and really you have them installed already — why not have that security camera alert you when a line gets too long at your cash register? Or when you are monitoring an exterior door, what if someone were to put a pallet in front of that door and it is an emergency exit? You can use those analytics to notify you of that,” he describes.

Garms says there are countless other examples of how you can use your security cameras that are in place to help drive your business. “What we found is it also helps to open up the company’s wallet from other groups to contribute to upgrade their cameras and their systems. So now you are not just talking about the security department who is looking at their budget, but perhaps the marketing department that wants a store heat map of how customers are traveling throughout the store and these sorts of things. And so we are seeing opportunities from that aspect as well.”

Scott Dunn, Axis Communications Inc., says cross-functional use of video is one of the major drivers of market growth. “We are seeing a lot of that interesting cross-functional use whether it is for a retail business or for classrooms where you can do remote learning and do surveillance,” Dunn says. “Recently we were doing a project down in Atlanta with smart traffic. We just completed a pilot down there and now we are going to do hundreds of intersections. They already have cameras across the city for their video surveillance project, and now we are simply loading some of our traffic analytics on to the cameras and then feeding that into a traffic system. So from the same video from the cameras they are able to get better traffic flow, and you get better response and avoid traffic jams. It is saving them a ton of money, and the video has dual purpose.”

Jake Cmarada, senior business development manager, enterprise sales, Dahua Technology USA, Irvine, Calif., agrees, explaining they are seeing a demand for new sensors and other devices to be used and added to traditional security solutions to deliver new and valuable deliverables. “Incorporating new devices and increasing the AI and BI functions and reporting will continue to turn traditional security projects into robust AI/BI/smart city solutions with a variety of ROI incentives,” he says.

Garms admits integrator adoption of these cross-functional uses of video has not been as fast as it could be. “I think it has been slow,” he says. “It is outside their normal areas; they are used to talking with loss prevention guys, but I think some of the more sophisticated, larger integrators now that we’re partnering with are taking this up and are seeing the opportunity there to go beyond security and begin developing relationships with other parts of the organization.”

Too Much of a Good Thing?

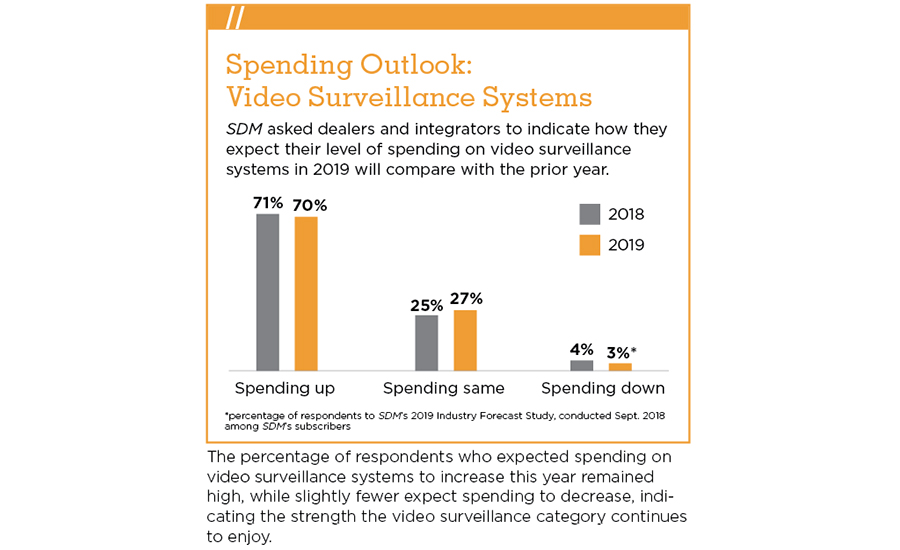

SDM asked dealers and integrators to indicate how they expect their level of spending on video surveillance systems in 2019 will compare with the prior year.

The percentage of respondents who expected spending on video surveillance systems to increase this year remained high, while slightly fewer expect spending to decrease, indicating the strength the video surveillance category continues to enjoy.

Steven E. Paley, president and CEO, Rapid Security Solutions, Sarasota, Fla., says that with security on everyone’s mind, he finds it hard to believe that anyone providing a decent level of service would not be growing their business in this economy. “Really for us we have to make sure the growth is controlled so that we can still provide a high level of service and have enough technicians to actually install and service the stuff,” Paley says.

With this unprecedented growth, Rapid Security, which does around 75 percent video surveillance or access control work, has had to evaluate its workforce to make sure they are not taking on too much work and overloading the system. “We’ve had to shed some clients,” Paley explains. “We look at the client and ask ourselves what is the strategic value to us of taking on this new client? Because we don’t need work just for work’s sake.”

This streamlined philosophy is a result of a bad experience that Paley calls “breaking the machine” when his company took on bigger and bigger projects for which they were not prepared staff-wise to handle in early 2018. “We’ve cleaned up the mess, so to speak, but I think we learned a lesson about growth this year. If resources were unlimited it would be one thing. … We just have to be careful about how we grow out in the future.”

The Cyber Stance

SDM asked several security integrators, manufacturers, and organizations around the industry: What kind of impact is cyber having on the market, and what steps can dealers and integrators take in that area to protect and prepare?

“The industry grew as demand for video surveillance increased exponentially, albeit with little regard to cyber issues until three or four years ago. Much has been done by the manufacturers to make products more secure, but much more needs to be done. The IP portion has created new markets for integrators to explore and create offerings.

We are seeing integrators morph their business into more than just physical security. They are helping clients with the operational technologies and the cyber security that these systems require.”

— Bob Dolan, director of technology, Anixter Inc., Glenview, Ill.

“In general, I think the cyber threat has had a positive effect; I think it raises awareness. …I think it helps to drive best practices and ultimately I think it will lead to customers doing a better job of safeguarding their businesses. Of course, there is never an end-all/be-all solution to cyber security, but certainly employing some of the industry best practices can get you a little closer and a little less vulnerable.”

— Tim Baker, global marketing director for commercial security, Honeywell Security and Fire, Melville, N.Y.

“If anything, the public nature of some of the incidents that have occurred — and the sensitivity to the perception of private video potentially being exposed — have significantly increased the awareness and focus from the industry on taking the necessary steps to improve our systems’ security.”

— Brandon Reich, vice president of security and IoT, Pivot3, Austin, Texas

“The threats are daunting and the security industry must continue to develop better answers that protect our clients. Password management is one common problem across all manufacturers.”

— Bret McGowan, senior vice president, marketing and sales, Vicon Industries Inc., Hauppauge, N.Y.

“Cyber security awareness has positively impacted the industry. Physical security groups have become much more aware of the impacts of cyber security vulnerabilities and how these risks can greatly impact their organizations, up to and including loss of recorded video, loss of control of systems, or ransomware attacks.”

— Fredrik Wallberg, director of marketing for security and ITS, FLIR Systems, Wilsonville, Ore.

“The risks from poorly designed surveillance systems on the internet are now well documented, and IT is typically taking a much more direct involvement in system design and product choices. Requirements for products that offer 16-digit ASCII passwords, NIST-level encryption, multi-level identification/validation, and implementing up-to-date network security protocols are now routine in surveillance projects, and will go a long way toward providing basic cyber protection.”

— Jeff Whitney, vice president of marketing, Arecont Vision, Glendale, Calif.

“The cyber education and messaging is finally generating the kind of awareness necessary to improve out data protection standards. First off, isolate cameras on a separate network. Secondly, encrypt the video data at rest and in flight.”

— Ken Francis, president, Eagle Eye Networks, Austin, Texas

“Cyber security continues to be a key concern for end users and integrators alike. However, securing the security system starts with the integrator. Integrators need to know which technologies offer the greatest data protection. Software encryption, pseudonymization, hardware encryption and secure erase are just some of the protocols integrators should be recommending to their customers.”

— LayPeng Ong, senior director of global sales and emerging business, Seagate Technology, Cupertino, Calif.

An important piece of the puzzle is getting the right people in place to meet the challenges of this market. That’s easier said than done, according to many integrators. Bill Hogan, president and CEO, owner, D/A Central, Oak Park, Mich., says the market for talent is the key challenge. “It is far more important than competition and technology. Finding talent is a full-time job, and the second part of it is ongoing training. Every employee wants a career path and not just a job. We are finding great success with bringing in new people with little experience and giving them an opportunity to grow.”

A Market in Flux

In addition to the growing pains and the struggle to fill positions with good, qualified people, security integrators are finding that the video surveillance market isn’t the same as it was 10 years ago.

“It used to be once upon a time we dealt a lot more on the hardware side of life,” says Joey Rao-Russell, president and CEO, Kimberlite Corp., a Sonitrol franchise, Fresno, Calif. “Now there’s this whole other software piece — whether it’s intrusion, access control, any of it — where security-as-a-service is becoming probably the largest trend that makes it a lot more interactive perhaps than it used to be.”

Rao-Russell says that while video was part of 44 percent of Kimberlite’s sales last year, many of those sales included interactive services with video and access control together or video and intrusion together.

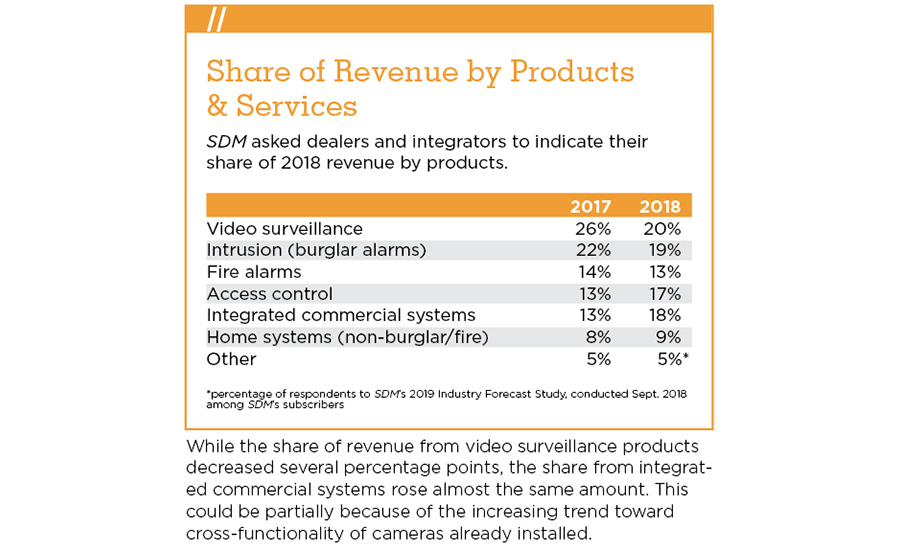

SDM asked dealers and integrators to indicate their share of 2018 revenue by products.

Tim Baker, global marketing director for commercial security, Honeywell Security and Fire, Melville, N.Y., agrees that although the economy is having an impact, it is affecting video less so than in some other businesses, such as fire alarm. Baker says it is integrated solutions in general that are helping to grow video. (For more about the increasing uses of video, see “Video Wears Many Hats,” on page 40.) “Instead of just asking for video solutions from integrators,” Baker says, “customers are asking, ‘Are there other ways that I can get video validation of alarms?’ as an example.”

Something that is facilitating this change, Baker says, is hardware and software that are advancing to the point that they can bring together a range of different systems along with enabling technologies such as artificial intelligence (AI). Baker says with that type of thinking added to the existing building space, “We are uniquely positioned and can help our integrators grow by providing end users with multiple paths to upgrade — whether that means starting with access control or video or intrusion and then leveraging existing infrastructure, whether it’s IP or coaxial in nature, and using that existing infrastructure as a means to then upgrade to the latest technology and combining security systems with the latest third-party technology like artificial intelligence or deep learning and solve a different range of challenges for our customers.”

Rather than seeing security industry growth as something that happens in greenfield environments, Baker says more and more integrators are able to focus on existing spaces and then use those as an opportunity to have a conversation about how to integrate not just video, but video along with access control, with intrusion, with other building management systems. “It is a really good path to growth with our integrators,” he adds.

Self-Policing > Government Regulations

At the time of writing, the government is currently shut down in a deadlock over funding of the border wall. The government excels at stalling, disagreeing and partisan politics. With that in mind, to what extent can we expect government regulations to be the answer for cyber security and related issues?

The government is going to mandate cyber security, says Joey Rao-Russell, Kimberlite Corp., but the government will be behind — “they always are,” she says. “There have been standards for 30 years for how we monitor things from ANSI and UL, and there are still bad companies, for lack of a better way to put it, that don’t comply. I think the legislation will always be there, but it is going to be incumbent on our manufacturers to develop products that can be compliant.”

Of course, the legislation does have an effect on the market. Take, for instance, the NDAA that was passed in 2018 banning the use of certain Chinese-made camera brands in U.S. government facilities and in U.S. government-funded contracts starting in mid-2019. Fredrik Wallberg, FLIR Systems, says these regulations have led integrators and end users to evaluate alternative products from different suppliers. “At FLIR, we have seen a stronger demand for our solutions, which are primarily manufactured in the U.S., Taiwan or other countries that are not impacted by U.S.-China trade relations. We have also seen increased awareness about the overall value and performance of video solutions as a key deciding factor, more than price point alone.”

Rao-Russell explains that standards, legislation and compliance will never move as fast as the threats, however: “Keep in mind, by the time some kind of legislation for cyber security comes out and has made it through legislation, the hackers are already 12 steps ahead of us. So it becomes incumbent upon the general public to enlist best practices and invest. In some respects, it becomes a self-policing and, frankly, a self-preservation because I absolutely don’t want to be hacked, and I don’t want my customers’ information going out there. I think we will police ourselves more than legislation,” she concludes.

Baker says that whether it is using video in the security space for intrusion detection or in place of motion sensors or for access management for a second set of credentials, or if it is using video for outside security use cases such as space optimization or people counting, “it is coming closer to realizing the video camera as the ultimate edge device in the security system.”

Even though the general perception is that cameras are well-saturated in an existing infrastructure, Baker maintains there is still an opportunity to drive more value out of those cameras by using them for these additional use cases. “So that could be, for an integrator, selling analytics licenses or being able to upgrade that camera to be able to provide the level of fidelity needed to use that camera as a sensor in a different use case. That can definitely be a path to RMR, especially when you talk about being able to tie analytics licenses on a per-camera, per-channel basis.”

As end users are more aware of the possibilities, they are crying out for solutions that actually solve specific problems, says Bill Hobbs, senior vice president of sales, 3xLOGIC, Westminster, Colo. “Providing an end user a picture or video of the event long after the damage is done does not solve the problem,” Hobbs describes. “End users are becoming more sophisticated buyers as the control of security solutions moves from the basement to the IT team. The effect of this migration has been and continues to be an end user who is asking better questions and wants products that do not burden.”

Hogan says he is optimistic about the growth of the market going into 2019, but he adds, “I am cautious about our vigilance in keeping ahead of technology. Commoditization of new technology seems to be happening overnight. If we are not pushing the technology window, we are at risk of being left behind.”

And so the question becomes, can the security integrator evolve at the same rate that the video surveillance market evolves?

Evolving Integrators for an Evolving Industry

As end users become more savvy, they are challenging integrators to mix-and-match the best of their technologies from a host of different manufacturers to effectively solve problems for them. (For more about interoperability issues with video surveillance devices, see “You Keep Using That Word…” on page 38.)

Security integrators will find it more difficult to find all aspects of a complete solution from a single source and will need to be adept in knowing which third-party provider has the right analytics package to power the solutions that may already come from several manufacturers. “Having integrators that are able to do that level of deep customization and integration is key,” Baker says. “It is definitely something that we are seeing asked for more and more, or we’re seeing integrators having to upsell that value.”

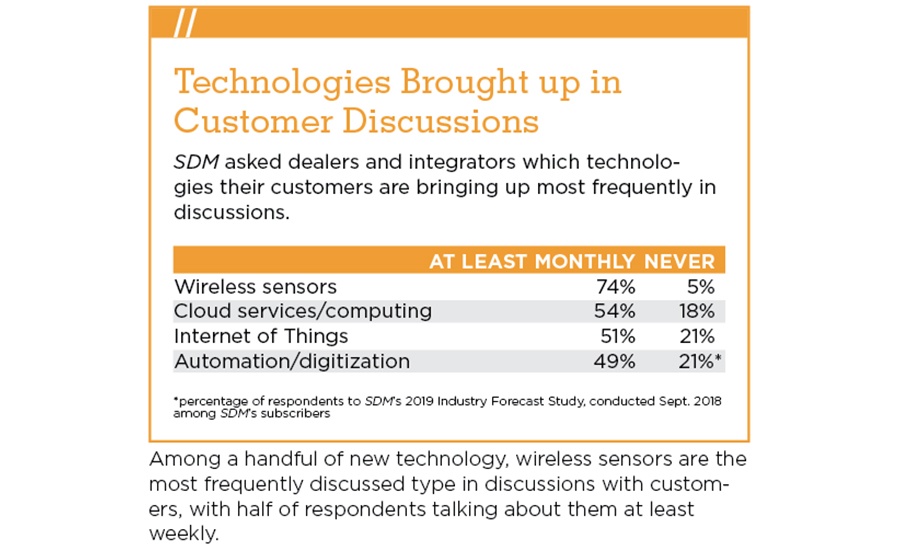

SDM asked dealers and integrators which technologies their customers are bringing up most frequently in discussions.

Ken Francis, president, Eagle Eye Networks, Austin, Texas, concurs, adding that a great deal of Eagle Eye Networks’ lead activity is being generated by end users searching for a cloud/subscription system that alleviates their management of the day-to-day operational aspects of their video surveillance system.

Fortunately, organizations are rising to the challenge and offering security integrators the support and education they need to be better qualified to offer the complete solutions customers are demanding. Bosch, for instance, has a new offering now for on-site support for installations. “We will actually send people out from Bosch to help with larger, more complex installations,” Garms says. “So that is one of the areas where we are creating an offering to help integrators who may not have that trained install force. I think the other piece is training. We are doing more and more online training courses, making sure we offer enough online and hands-on training across the board for integrators.”

Garms says this approach can help, but with high turnover and the difficulty some integrators are having hiring installers and technicians proficient in all aspects of networking and connected applications, in addition to the traditional video surveillance and security-related devices and services, offering support and training alone is not enough. Garms says that training and ease-of-installation go hand-in-hand: “The easier we can make it to install, the less training they need.”

Alliance Designed to Foster Collaboration Innovations

To what extent does the media’s coverage of security breaches, burglaries, mass shootings and crime play into the public’s desire to have security systems? The robust economy alone cannot account for people’s desire to be secure; people are more than ever aware of what is going on in the world, and they are fearful, says Steven Paley, Rapid Security Solutions.

It’s a common trope: Back when I was growing up, parents let us kids be kids. Nobody knew where we were all day during the summer, we didn’t wear seatbelts, people smoked in front of us, we ate peanuts and all sorts of non-organic food, and we turned out fine!

Most of these practices — free-roaming children in particular — have been, for the most part, phased out of general acceptance as the media zeroed in on one horrific kidnapping or another, covered it ad nauseam, and scared parents just enough so that they couldn’t shake the nagging thought: It probably won’t happen to my kids, but if it ever did, I’d never forgive myself. That kind of doubt can be a powerful persuader, and while the number of children abducted by strangers is miniscule and the number of total missing persons of all ages is trending down (FBI statistics show a 31 percent decrease between 1997 and 2011 according to The Washington Post), parents seem to keep their children under constant supervision more than ever.

“When I was a kid, my mother didn’t know where I was. There were no cellphones. Just be home before your dad gets home at five,” says Paley. “And now my daughter has a GPS tracker on her phone and a GPS tracker in her car, and there is not a minute that goes by that I don’t know where she is.”

It’s not that parents didn’t know crime existed. “The crime has always been there,” Paley says, “but people are just more paranoid about it.”

Paley says this is something that comes up in discussions with clients and colleagues. “I don’t think this is specific to our company,” he continues. “I think every company is scrambling to provide newer technologies. People are asking for it. In Florida, where we are based, gated communities are a big vertical market for us. Gated communities, condos, homeowners’ associations — these people are frantic about who is coming onto their property; and they want gates, they want fencing, they want access control, they want to know who is coming and going — and it’s because of what they are seeing on the news. Twenty years ago people would say, ‘We haven’t really had an incident. We are good.’ And now no one wants to be the next victim. Some of the solutions we’re providing are more of a blanket or a perception thing, but no homeowners’ association board wants to be the ones that could have prevented a shooting or theft. So I think it’s just that instant access to the news and what is happening around the world that is driving a lot of this growth.”

Sometimes this awareness effects positive changes, such as the 1984 establishment of the National Center for Missing and Exploited Children, and certainly the public’s awareness of digital threats and the need for greater cyber security.

This, of course, is an opportunity for dealers and integrators to come in and provide the peace of mind customers want. Regardless of opinions about the information age and the 24-hour news era, it is important to understand this desire for security and to specifically show customers how technology can make them secure.

Unfortunately, Hogan says, technology often comes to market that is left under-utilized: new features are not activated, training is lacking, and the result is far less impactful than the promise. “Configuring and training is a value-add for the systems integrator to show off the new technology,” he explains. “Once you have shown end users how to utilize the new features, they love the enhancements. Unfortunately, I see many end users still using an old interface, seemingly unaware of how the system can help them do their job.” This is where educated and knowledgeable security integrators can really differentiate themselves and help their customers see the value the integrators have brought to the table.

With that in mind, continuing education is needed across the country. “Many are talking about the Internet of Things,” says Bob Dolan, director of technology, Anixter Inc., Glenview, Ill., “but each of us grasp it in unique ways. As a result, different definitions and terminologies are emerging and causing confusion at all levels of the market — end users, integrators, distributors, manufacturers, consultants, architects and others.”

Thankfully, groups and individuals are seeing the need and taking steps to meet the needs. In fact, Garms described the recent launching of the Open Security and Safety Alliance (OSSA), of which Bosch is a founding member. The goal of this organization, Garms says, was to develop a framework that would set standards and specs for components not just of video but also including the operating system of the cameras, because most manufacturers have their own proprietary operating systems. “Standardizing as an industry on some things will certainly improve the speed at which we can all develop and bring third parties in to develop for us to hasten our progress toward AI and analytics and some of the other things that we want to do,” Garms describes. (For more about the OSSA, see “Alliance Designed to Foster Collaboration Innovations” on this page.)

The Media Makes Chicken Littles of Us All

To what extent does the media’s coverage of security breaches, burglaries, mass shootings and crime play into the public’s desire to have security systems? The robust economy alone cannot account for people’s desire to be secure; people are more than ever aware of what is going on in the world, and they are fearful, says Steven Paley, Rapid Security Solutions.

It’s a common trope: Back when I was growing up, parents let us kids be kids. Nobody knew where we were all day during the summer, we didn’t wear seatbelts, people smoked in front of us, we ate peanuts and all sorts of non-organic food, and we turned out fine!

Most of these practices — free-roaming children in particular — have been, for the most part, phased out of general acceptance as the media zeroed in on one horrific kidnapping or another, covered it ad nauseam, and scared parents just enough so that they couldn’t shake the nagging thought: It probably won’t happen to my kids, but if it ever did, I’d never forgive myself. That kind of doubt can be a powerful persuader, and while the number of children abducted by strangers is miniscule and the number of total missing persons of all ages is trending down (FBI statistics show a 31 percent decrease between 1997 and 2011 according to The Washington Post), parents seem to keep their children under constant supervision more than ever.

“When I was a kid, my mother didn’t know where I was. There were no cellphones. Just be home before your dad gets home at five,” says Paley. “And now my daughter has a GPS tracker on her phone and a GPS tracker in her car, and there is not a minute that goes by that I don’t know where she is.”

It’s not that parents didn’t know crime existed. “The crime has always been there,” Paley says, “but people are just more paranoid about it.”

Paley says this is something that comes up in discussions with clients and colleagues. “I don’t think this is specific to our company,” he continues. “I think every company is scrambling to provide newer technologies. People are asking for it. In Florida, where we are based, gated communities are a big vertical market for us. Gated communities, condos, homeowners’ associations — these people are frantic about who is coming onto their property; and they want gates, they want fencing, they want access control, they want to know who is coming and going — and it’s because of what they are seeing on the news. Twenty years ago people would say, ‘We haven’t really had an incident. We are good.’ And now no one wants to be the next victim. Some of the solutions we’re providing are more of a blanket or a perception thing, but no homeowners’ association board wants to be the ones that could have prevented a shooting or theft. So I think it’s just that instant access to the news and what is happening around the world that is driving a lot of this growth.”

Sometimes this awareness effects positive changes, such as the 1984 establishment of the National Center for Missing and Exploited Children, and certainly the public’s awareness of digital threats and the need for greater cyber security.

This, of course, is an opportunity for dealers and integrators to come in and provide the peace of mind customers want. Regardless of opinions about the information age and the 24-hour news era, it is important to understand this desire for security and to specifically show customers how technology can make them secure.

The security/surveillance industry has ebbs and flows of challenges, Rao-Russell describes. “Right now we are in one of the more challenging times due to changes in technology and changes in how things work and trying to balance legacy versus new versus speed of change and those types of things. I still think it’s very optimistic for what we do.”

Rao-Russell sees the business more holistically — as less of a business and more of a general service provided. “It’s not just the security that we provide and the video we provide; we honestly provide peace of mind,” she says. “We get to make money protecting people. That’s a valuable thing. We’re going to change the way we do it, but it is still a valuable business. So if we do it right and if we are diligent and if we are respectful of what the customer wants, I think the sky is still a limit for our industry.”

Source: SDM